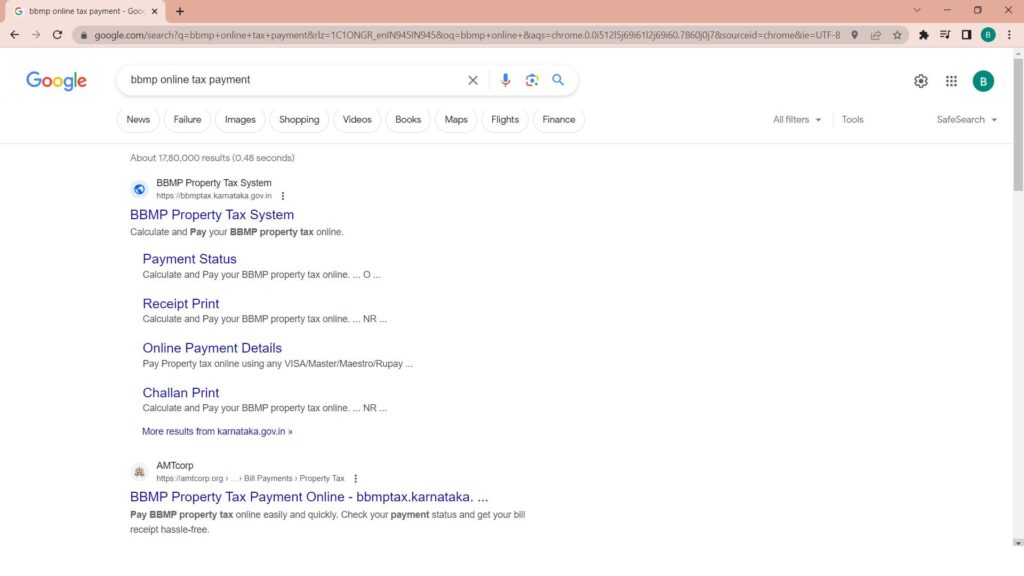

The first step is to visit the official website of the Bruhat Bengaluru Mahanagara Palike (BBMP). To do this, open your web browser and type “BBMP online tax payment” in the Google search bar.

From the search results, click on the first link that leads you to the BBMP’s official online tax payment portal.

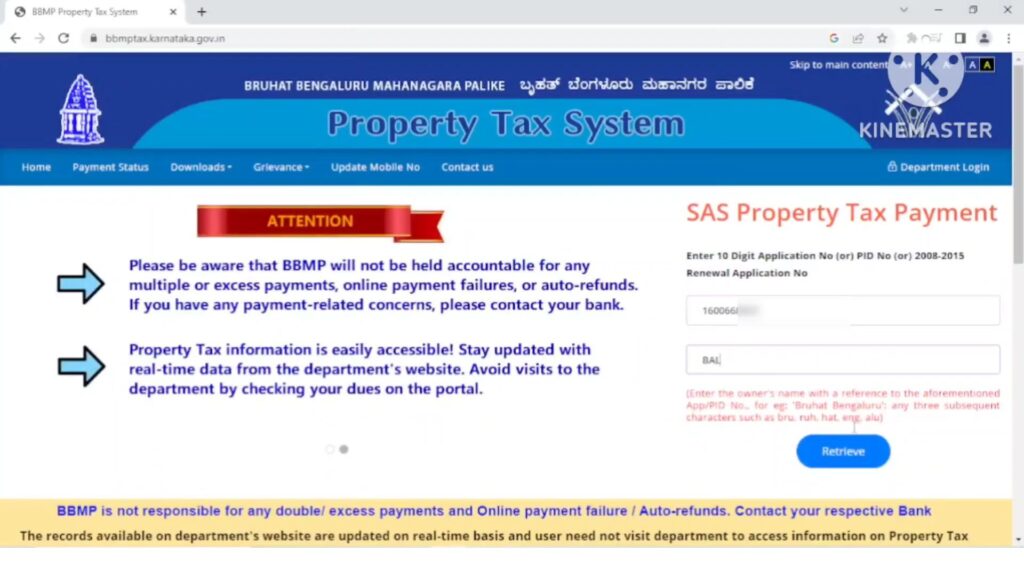

If you have paid your property tax in the previous financial year (2021-2022), you’ll need to check your tax paid receipt to find the application number and owner’s name.

Once you have the application number and the owner’s first three letters of the name, input these details in the designated boxes on the portal. Click on “retrieve” to proceed.

Upon clicking “retrieve,” the portal will display the owner’s details, including the name, ward number, and ward name. It’s essential to cross-check this information for accuracy before clicking “confirm.”

On the “SAS Property TAX Payment” page, you will encounter a check box and text in red, asking you to confirm any changes in property usage, built-up area, or occupancy. This step is crucial for record-keeping and proper tax assessment. you must tick the check box if

By checking the box, you are confirming that there have been changes in one or more of these aspects, and this information is crucial for legal or administrative purposes. It helps the relevant authorities to keep records updated and ensure that the property is properly assessed and taxed based on its current status.

later

Enter the 6-character captcha displayed and click on the “proceed” button. to continue

After proceeding, you will be directed to “Form IV,” where you will find a detailed tax amount breakdown, including rebates, penalties, interest, solid waste management cess for 12 months, balance property tax payable, the total amount due etc.,

While on “Form IV,” you’ll find three radio buttons for full payment, first half payment, and second half payment. Choose the appropriate option. If you wish to pay the full amount, you can do so, or you may opt for two partial payments.

Absolutely! The BBMP’s official website ensures secure payment gateways and data encryption to protect your sensitive information. Always make sure you are using the official website and not falling prey to phishing attempts.

Yes, you can pay property tax online even after the due date. However, it is advisable to pay before the due date to avoid any penalties or late fees.

In case of any technical issues or errors during the online payment process, you can reach out to the BBMP’s helpline or visit their office for assistance.

Information provided herein is in good faith only.

Neither me nor BNT Infra Pvt. Ltd. does not hold any responsibility for mis-interpretation, any kind of loss occurring due to this post. It is the responsibility of the end user to validate the information from subject matter experts/advocates/concerned authority & proceed accordingly.